Featured

Table of Contents

Consumers who enroll in the AMP program are not eligible for installment plans. Web Energy Metering (NEM), Straight Gain Access To (DA), and master metered consumers are not currently qualified. For customers intending on moving within the next 60 days, please put on AMP after you've developed solution at your new move-in address.

Governments and establishments make use of these forgiveness programs to advertise professions in fields that use civil service however could not offer wages. Examples consist of training in poorer areas or exercising medicine in internal country neighborhoods. One important aspect of financial obligation mercy associates with tax obligation status. The general guideline for the IRS is that forgiven financial obligation revenue is taxable.

The PSLF program is for consumers who are employed full time in certifying civil service work. You would need to be eligible when you have actually made 120 certifying settlements under a qualifying settlement plan while helping a certifying employer. When you have actually met this requirement, the balance on your Straight Lendings is forgiven.

Finding Help Through APFSC - Questions

This is to urge teachers to serve in locations where they are most needed. IDR plans to adjust your regular monthly student finance repayment amount based upon revenue and household dimension. Any kind of superior equilibrium is forgiven after 20 or 25 years of eligible settlements, depending upon the details chosen actual plan.

During the COVID-19 pandemic, the U.S. government executed short-term alleviation procedures for its government student loan debtors. The CARES Act put on hold car loan repayments and set rates of interest at 0% for qualified federal student finances. Although it was seen as a short-term alleviation procedure, it was not financing forgiveness. Private pupil lendings can not be forgiven under the federal lending mercy programs since they are issued by personal lenders and do not bring the backing of the federal government.

Refinancing: In some cases, a customer gets a new financing with better terms to settle existing loans. Settling may entail a reduced rates of interest or even more workable month-to-month repayments. Combination: combines several car loans right into one, making the settlement simpler. Good debt is required, so not all customers might qualify.

Establishing a Stable Budget That Lasts for Dummies

Some private loan providers provide case-by-case hardship programs. These consist of momentarily making interest-only repayments, momentarily lowering payments below the agreement rate, and even other forms of holiday accommodations.

Some of the financial debts forgiven, particularly acquired from financial debt negotiation, additionally adversely influence credit score ratings. Usually, the argument about financial debt forgiveness concentrates on its lasting results.

Forgiveness of big amounts of financial obligation can have significant monetary implications. It can include to the national financial debt or require reallocation of funds from other programs.

Understand that your car loans might be purely federal, purely private, or a combination of both, and this will certainly factor right into your selections. Mercy or repayment programs can quickly line up with your lasting financial goals, whether you're getting a house or preparation for retirement. Recognize just how the various sorts of financial obligation alleviation might affect your credit report and, later, future borrowing capacity.

Some Known Questions About Understanding Various Debt Forgiveness You May Know About.

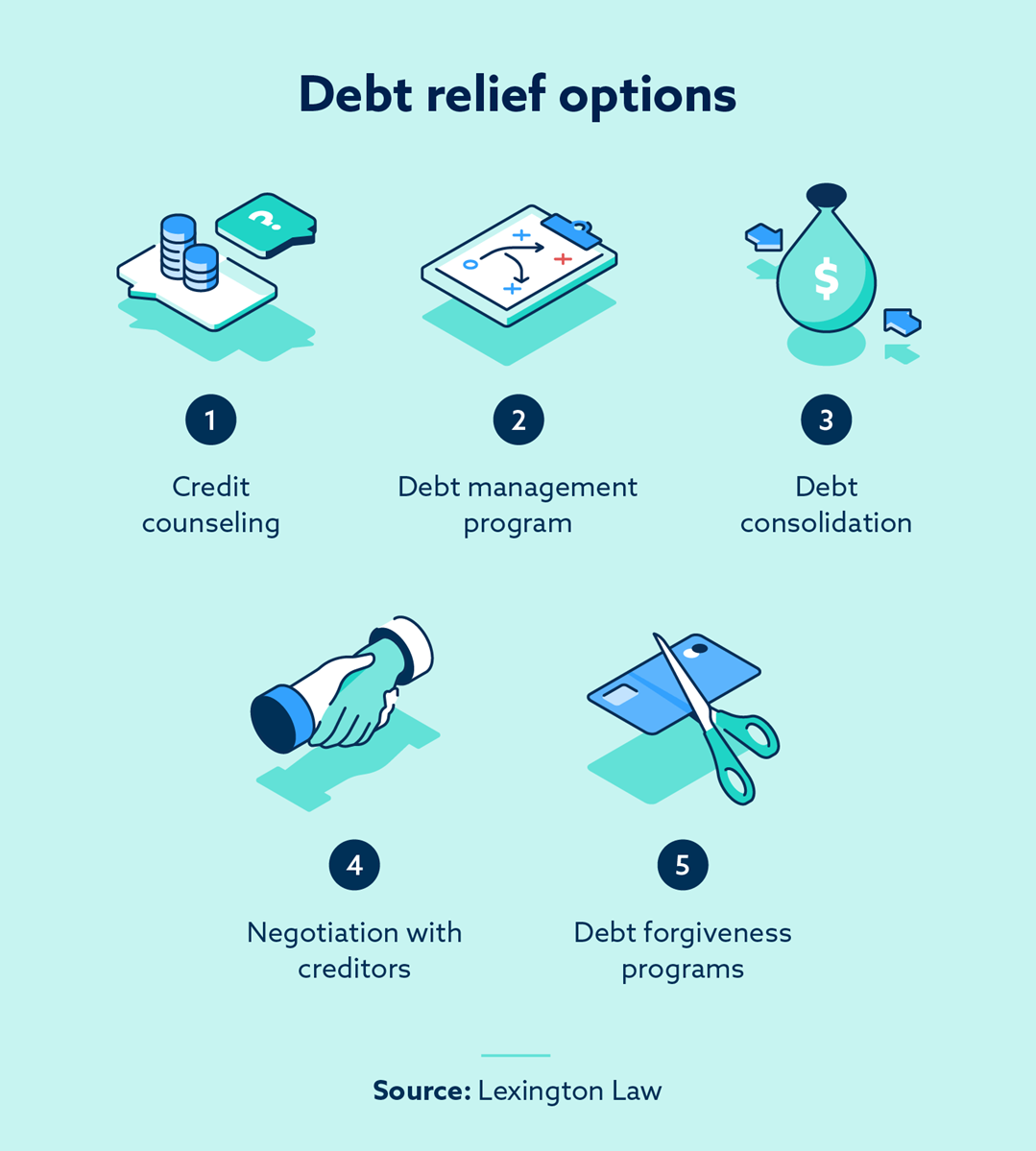

Debt mercy programs can be a real lifesaver, however they're not the only way to deal with installing debt. They can decrease your regular monthly payments currently and may forgive your staying financial obligation later.

You can use economic applications to view your costs and established money objectives. 2 means to repay financial obligation are the Snowball and Avalanche approaches. Both aid you concentrate on one financial obligation at a time: Pay off your smallest financial debts. Pay off financial obligations with the greatest rates of interest first.

Prior to determining, think of your own cash circumstance and future plans. It's smart to discover all your selections and speak with a cash specialist. By doing this, you can choose that will certainly aid your funds over time. Irs. (2022 ). Canceled Debts, Repossessions, Foreclosures, and Desertions (for People).

Unlike debt consolidation, which combines multiple debts into a solitary funding, or a debt management plan, which restructures your payment terms, financial debt mercy straight reduces the principal equilibrium owed. The continuing to be equilibrium is then forgiven. You may select to discuss a settlement on your very own or employ the help of a debt negotiation business or a seasoned financial obligation help lawyer.

Not simply anyone can obtain charge card financial obligation mercy. You generally need to be in dire economic straits for loan providers to even consider it. Particularly, financial institutions look at various elements when thinking about debt forgiveness, including your earnings, assets, various other financial obligations, capability to pay, and determination to cooperate.

The Buzz on True Experiences of How Debt Counseling Helps You Tackle Debt Effectively : APFSC Users

In some cases, you might be able to solve your debt circumstance without resorting to insolvency. Focus on important costs to boost your economic scenario and make space for financial debt repayments.

Table of Contents

Latest Posts

The Greatest Guide To A Guide to Debt Forgiveness for Burdened Families

How Why Delaying to Pursue Why Low-Interest Loans Are a Lifeline for Veterans Navigating Civilian Life Will Cost You can Save You Time, Stress, and Money.

Some Known Incorrect Statements About Building Your Journey to Relief

More

Latest Posts

The Greatest Guide To A Guide to Debt Forgiveness for Burdened Families

Some Known Incorrect Statements About Building Your Journey to Relief